State Farm tops the list of the top 5 car insurance companies in the USA, followed by Geico, Progressive, Nationwide, and Allstate. These companies offer a range of policies catering to various needs.

When it comes to choosing a car insurance provider in the United States, it’s essential to consider factors such as financial strength, customer satisfaction, and coverage options. State Farm, as the largest auto insurance company in the U. S. , holds a significant market share and is known for its reliability.

Geico, Progressive, Nationwide, and Allstate are also reputable options offering competitive rates and excellent customer service. By comparing these top providers based on your specific requirements, you can find the best car insurance policy to suit your needs.

Overview Of Top 5 Car Insurance Companies In Usa

State Farm, Geico, Progressive, Allstate, and USAA are the top 5 car insurance companies in the USA. As per the National Association of Insurance Commissioners, State Farm holds the largest market share in the US. These companies offer diverse coverage, affordable rates, and excellent customer satisfaction.

Introduction

In the United States, choosing the right car insurance company is crucial to protect your vehicle and finances. The Top 5 Car Insurance Companies in USA offer a variety of coverage options and excellent customer service. Let’s explore the overview of these leading insurance providers.

Methodology For Ranking

When evaluating the top car insurance companies in the USA, factors such as customer satisfaction, coverage options, financial stability, and affordability are considered. The following list is based on market share, ratings from independent agencies, and overall customer feedback.

You can choose to present the ranking in a table format

| Rank | Company |

|---|---|

| 1 | State Farm |

| 2 | Geico |

| 3 | Progressive |

| 4 | Allstate |

| 5 | American Family |

“` This HTML markup provides an engaging and informative overview of the Top 5 Car Insurance Companies in the USA, including an introduction and methodology for ranking the companies. The information is presented in a clear and structured format, making it easy for readers to understand and compare the leading insurance providers.

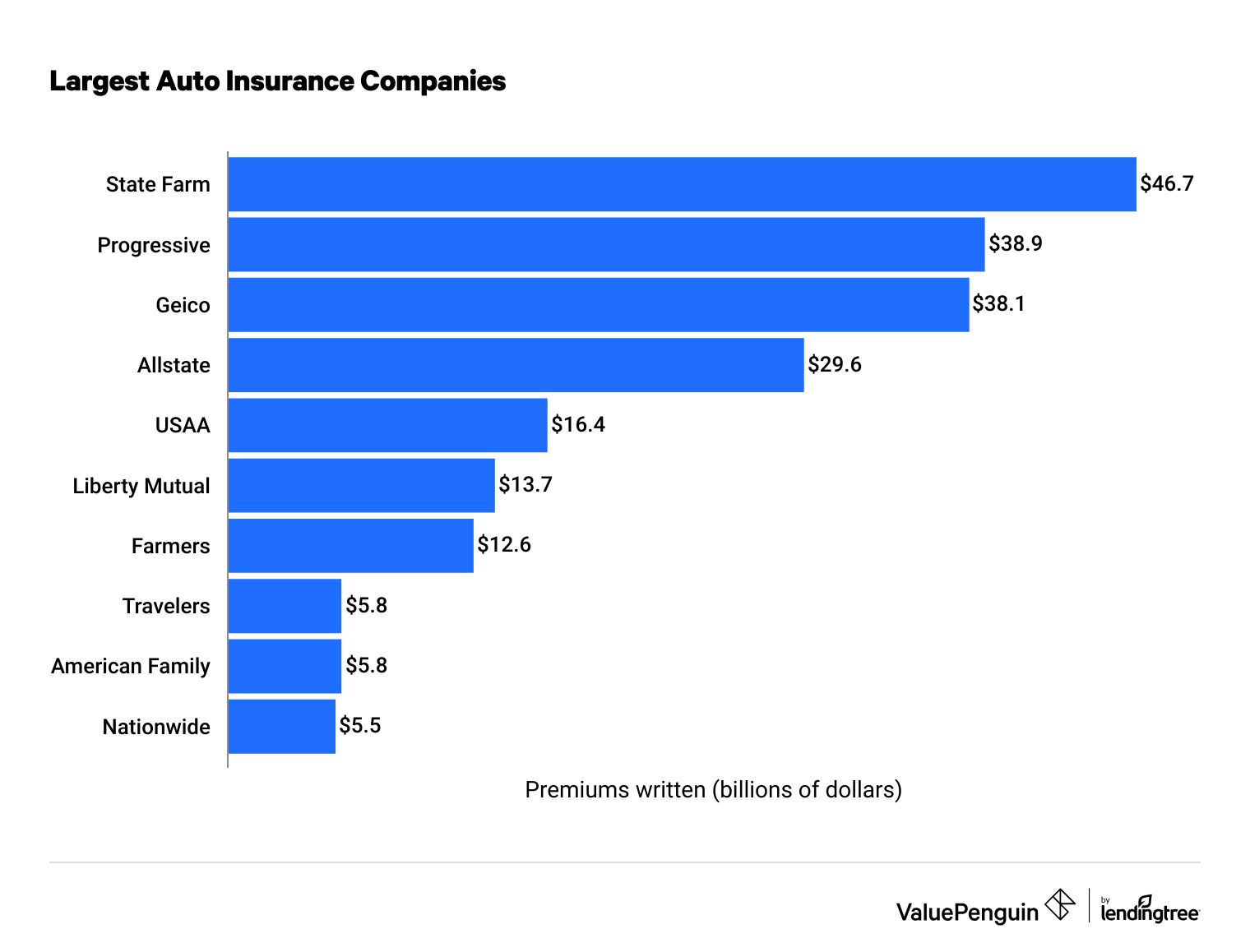

Credit: www.valuepenguin.com

Largest Auto Insurance Companies In The United States

When it comes to car insurance in the United States, it’s essential to choose a reliable company. The largest auto insurance companies provide peace of mind and financial security for drivers across the nation.

State Farm

State Farm ranks as the top auto insurance company in the U.S., holding the highest market share according to NAIC reports.

Geico

GEICO is a prominent player in the insurance industry, known for its competitive rates and customer-focused services.

Progressive

Progressive stands out for its innovative approach to insurance, offering a range of coverage options tailored to individual needs.

Allstate

Allstate is a well-established insurance provider, known for its reliability and comprehensive coverage plans.

Usaa

USAA caters to military members and their families, providing specialized insurance solutions with exceptional customer service.

Best Car Insurance Companies For Specific Needs

When it comes to Top 5 Car Insurance Company in the USA, State Farm ranks as the largest based on market share. Geico, Progressive, Nationwide, and USAA are also top choices for specific needs and affordability. These companies offer a range of coverage options for different preferences.

Best Car Insurance Companies for Specific Needs Affordability When it comes to finding the best car insurance company for your specific needs, affordability is a crucial factor. Ensuring financial security while keeping costs manageable is a priority for many drivers. Below are the top 5 car insurance companies in the USA renowned for their affordability: – GEICO: With its competitive rates and various discounts, GEICO is a go-to choice for budget-conscious individuals. – Progressive: Known for its innovative Snapshot program and Name Your Price Tool, Progressive offers customized pricing to cater to diverse budget requirements. – State Farm: With its extensive network and range of policies, State Farm provides cost-effective coverage options for different demographics. Customer Satisfaction Customer satisfaction is another essential consideration when choosing a car insurance provider. Having reliable customer service and a hassle-free claims process can significantly impact the overall experience. These car insurance companies stand out for their high customer satisfaction: – USAA: Widely recognized for its exceptional customer service, USAA consistently earns top ratings for overall satisfaction. – Farmers: With its personalized approach and responsive claims handling, Farmers excels in meeting customer needs and garnering positive feedback. Wide Coverage For those seeking comprehensive coverage to protect their vehicles and themselves, it’s important to choose a car insurance company that offers a wide array of coverage options. The following companies are known for their extensive coverage plans: – Nationwide: Providing diverse coverage options, including vanishing deductibles and accident forgiveness, Nationwide caters to various insurance needs. – Allstate: Renowned for its customizable policies and numerous add-on coverages, Allstate is a top choice for comprehensive protection. Minimum Coverage When selecting a car insurance company, some individuals may only require minimum coverage to meet legal requirements. These companies offer reliable options for minimal coverage: – Liberty Mutual: With its user-friendly interface and straightforward policy options, Liberty Mutual is ideal for those seeking basic coverage. – GEICO: Apart from its affordability, GEICO offers minimum coverage solutions to ensure compliance with state laws. By considering these top car insurance companies based on specific needs, individuals can make informed decisions when it comes to selecting the most suitable insurance provider for their vehicles.

How To Assess The Financial Strength Of An Insurance Company

When it comes to choosing the right car insurance company, assessing the financial strength of the company is crucial. You want to ensure that the company you choose will be able to handle any claims or potential losses efficiently and effectively. In this section, we will explore how to evaluate the financial strength of an insurance company, with a focus on independent rating agencies and the factors to consider.

Independent Rating Agencies

Independent rating agencies play a vital role in evaluating the financial stability of insurance companies. These agencies assess the financial strength of insurers and assign them a rating based on their analysis. It is essential to consider ratings from multiple agencies to gain a comprehensive view of an insurance company’s financial stability.

Here are the key independent rating agencies you should consider:

- A.M. Best: A.M. Best is a top-rated agency in the insurance industry, known for its accurate and reliable assessments of insurers’ financial strengths.

- Fitch Ratings: Fitch Ratings provides credit ratings, research, and insights to help investors make informed decisions about insurance companies.

- Kroll Bond Rating Agency (KBRA): KBRA is a leading agency that provides ratings and research across several sectors, including insurance.

- Moody’s: Moody’s is one of the most recognized credit rating agencies globally, providing reliable ratings and analysis for insurance companies.

- Standard & Poor’s (S&P): S&P is a well-known agency that offers credit ratings, research, and risk analysis for insurance companies.

Factors To Consider

When evaluating the financial strength of an insurance company, several important factors should be taken into consideration:

1. Company’s Rating

Consider the rating assigned to the insurance company by the independent rating agencies. A higher rating indicates a stronger financial position and the ability to meet its policyholder obligations.

2. Financial Stability

Assess the company’s financial stability by reviewing its financial statements, including its assets, liabilities, and equity. Look for steady growth, adequate capitalization, and a low debt-to-equity ratio.

3. Claims Payment History

Examine the company’s claims payment history and how it has handled claims in the past. A reliable insurance company should have a track record of prompt and fair claims settlements.

4. Customer Satisfaction

Read customer reviews and ratings to gauge the company’s reputation for customer service and overall satisfaction. Happy customers are usually an indication of a reliable insurance provider.

5. Longevity in the Market

Consider the number of years the company has been operating in the insurance market. A well-established company with a long history often signifies stability and reliability.

By considering these factors and relying on the assessments of independent rating agencies, you can make a more informed decision when choosing a car insurance company with strong financial strength.

Additional Considerations For Choosing Car Insurance

When it comes to choosing car insurance, there are several factors you should consider beyond just the reputation and rates of the insurance company. These factors can ensure that you have the right coverage and protection for your needs. Below are some additional considerations to keep in mind.

For New Drivers

For new drivers, it’s essential to find an insurance company that offers special coverage options and discounts specifically tailored to their needs. Some insurance companies have programs designed to support and reward new drivers who maintain good driving habits. Look for insurance companies that offer these programs to help new drivers save on their premiums and build a positive driving record.

According To Consumer Reports

Consumer Reports is a reliable source for unbiased reviews and ratings of products and services. They also provide valuable insights and recommendations for car insurance. Consider reviewing their ratings and recommendations to get an idea of the best car insurance companies in terms of customer satisfaction, claims handling, and overall performance.

Personal Recommendations

One of the most powerful ways to gauge the quality of an insurance company is by seeking personal recommendations. Talk to your friends, family, and colleagues about their experiences with different car insurance companies. Consider asking them about their claim experiences, customer service satisfaction, and overall impression of the company. Personal recommendations can provide valuable insights that you may not find elsewhere.

By keeping these additional considerations in mind, you can ensure that you choose the right car insurance company that meets your specific needs and provides you with the coverage and support you require.

Credit: www.cnbc.com

Credit: www.nerdwallet.com

Frequently Asked Questions For Top 5 Car Insurance Company In Usa

What Is The #1 Auto Insurance In The Us?

State Farm is the top auto insurance in the US, leading in market share.

Which Insurance Is Best For Car In Usa?

State Farm is considered the best car insurance for USA based on market share.

Who Is The Top 5 Insurance Company?

The top 5 insurance companies are State Farm, Geico, Progressive, Allstate, and Nationwide Insurance.

What Are The Top 5 Insurance Rating Agencies?

The top 5 insurance rating agencies are A. M. Best, Fitch, Kroll Bond Rating Agency (KBRA), Moody’s, and Standard & Poor’s. These agencies assess the financial strength of insurance companies based on their own rating scale and standards.

Conclusion

In the ever-changing world of car insurance, it’s crucial to find a reliable and reputable company. The top 5 car insurance companies mentioned in this blog offer competitive rates and comprehensive coverage. Whether you prioritize affordability, customer satisfaction, or wide coverage, these companies have options to suit your needs.

As you navigate the process of choosing the best car insurance for you, keep these top contenders in mind.