A professional liability insurance company offers coverage for professionals and businesses against negligence claims. This type of insurance protects against claims of negligence, copyright infringement, and personal injury.

In Austin, Texas, there are several reputable companies such as HPSO, NSO, and Altor NATIONAL Liability Insurance that provide professional liability coverage. Professional liability insurance is essential for safeguarding businesses and professionals from potential legal risks and financial liabilities. It is not mandatory for most Texas businesses, but certain industries may require it to meet specific standards or contractual obligations.

Understanding the importance and benefits of professional liability insurance is crucial for ensuring comprehensive protection in today’s competitive business landscape.

Professional Liability Insurance: A Primer

Professional Liability Insurance Companies offer coverage for professionals against claims of negligence, copyright infringement, and more. This type of insurance protects businesses from potential lawsuits brought by clients or customers due to errors or omissions in their services. Trusted providers like AIG, Pogo, and The Doctor’s Company offer tailored solutions for different industries and professions.

Essential Coverage For Professionals

Professional Liability Insurance is an essential coverage for professionals who provide services to clients. This type of insurance protects professionals from claims of negligence or mistakes that result in financial loss for the client. It is also known as Errors and Omissions insurance or E&O insurance. Professional Liability Insurance is designed to cover the costs of legal defense, settlements, and judgments against the insured. It is important to note that general liability insurance does not cover professional mistakes or errors, which is why professionals need to consider Professional Liability Insurance.Negligence And Other Covered Risks

Professional Liability Insurance typically covers negligence, errors and omissions, misrepresentation, violation of good faith and fair dealing, and inaccurate advice or information. It also covers claims of copyright infringement, personal injury, and other risks that arise from the professional’s work. Depending on the policy, the coverage may include defense costs, damages, and settlements. It is important to read the policy carefully to understand what is covered and what is not covered.Comparison Of Professional Liability Insurance Providers

There are many providers of Professional Liability Insurance, and it can be challenging to choose the right one. Some of the top providers include AIG, Pogo, The Doctor’s Company, Embroker, Thimble Insurance, and Hiscox. Each provider has different coverage options and pricing, so it is important to compare them to find the best fit for your needs. It is also important to consider the provider’s reputation, financial stability, and customer service when making a decision.Professional Liability Insurance is a critical coverage for professionals who want to protect themselves from claims of negligence or mistakes. It is important to understand what is covered and what is not covered by the policy. It is also important to compare providers to find the best fit for your needs. With the right coverage, professionals can focus on their work, knowing that they are protected against potential risks.

Credit: www.thehartford.com

Evaluating Providers: Who Tops The List

Ranked at the top of the list for professional liability insurance companies is AIG, offering comprehensive coverage for various professionals against negligence claims. Other notable providers include Pogo for freelancers, The Doctor’s Company for medical professionals, Embroker for lawyers, and Thimble Insurance for small businesses.

Criteria For Best Insurance Companies

When evaluating professional liability insurance providers, several key criteria can help determine the best companies in the industry. These criteria include financial stability, coverage options, customer service, claims process efficiency, and industry reputation.Top Picks For Various Professions

Professionals in different fields require specialized coverage tailored to their specific risks. Here are some top picks for various professions:– Medical and Healthcare Providers: The Doctor’s Company – Lawyers: Embroker – Freelancers and Independent Contractors: Pogo – Small Businesses: Thimble Insurance – Realtors: HiscoxIn conclusion, evaluating professional liability insurance providers is crucial for ensuring comprehensive coverage tailored to your specific needs and risks. By considering the criteria for the best insurance companies and exploring the top picks for various professions, you can make an informed decision when selecting a provider.Pli In The Healthcare Sector

Professional Liability Insurance (PLI) is crucial in the healthcare sector, where the risk of malpractice claims is significant. Medical professionals, including doctors, nurses, and allied healthcare providers, rely on PLI to safeguard their practice from potential liabilities. Let’s delve into the special considerations for medical professionals and understand how PLI applies to medical billing in this sector.

Special Considerations For Medical Professionals

Medical professionals face unique risks due to the nature of their work, making professional liability insurance essential. Doctors, nurses, and allied healthcare providers must protect themselves from potential malpractice claims. PLI provides coverage for claims of negligence, misdiagnosis, surgical errors, and other professional liabilities specific to the healthcare sector.

Pli In Medical Billing Explained

Medical billing involves intricate processes and interactions with sensitive patient data. Professional liability insurance in medical billing is designed to protect billing professionals and their practices from potential claims related to billing errors, privacy breaches, and fraudulent billing practices. It safeguards against financial losses and legal ramifications in the event of such claims.

Credit: www.embroker.com

State Requirements: The Texas Case Study

Professional Liability Insurance (PLI) is not required for most businesses in Texas. However, certain industries and professions may necessitate coverage to comply with specific standards and regulations.

Is Pli Mandatory In Texas?

Professional Liability Insurance is not mandatory for most businesses operating in Texas. However, certain industries and professions may have regulations or contractual requirements that make PLI necessary for compliance.

Compliance With Industry Standards

Ensuring compliance with industry standards is crucial for businesses in Texas. While PLI may not be mandatory statewide, it is essential to understand and meet the specific requirements of individual industries and professions.

Coverage Details: What’s In And Out

Professional Liability Insurance (PLI) is a crucial safeguard for businesses and professionals, providing coverage against claims of negligence, errors, or omissions. Understanding the specific details of what PLI covers can help you make informed decisions to protect your business and reputation.

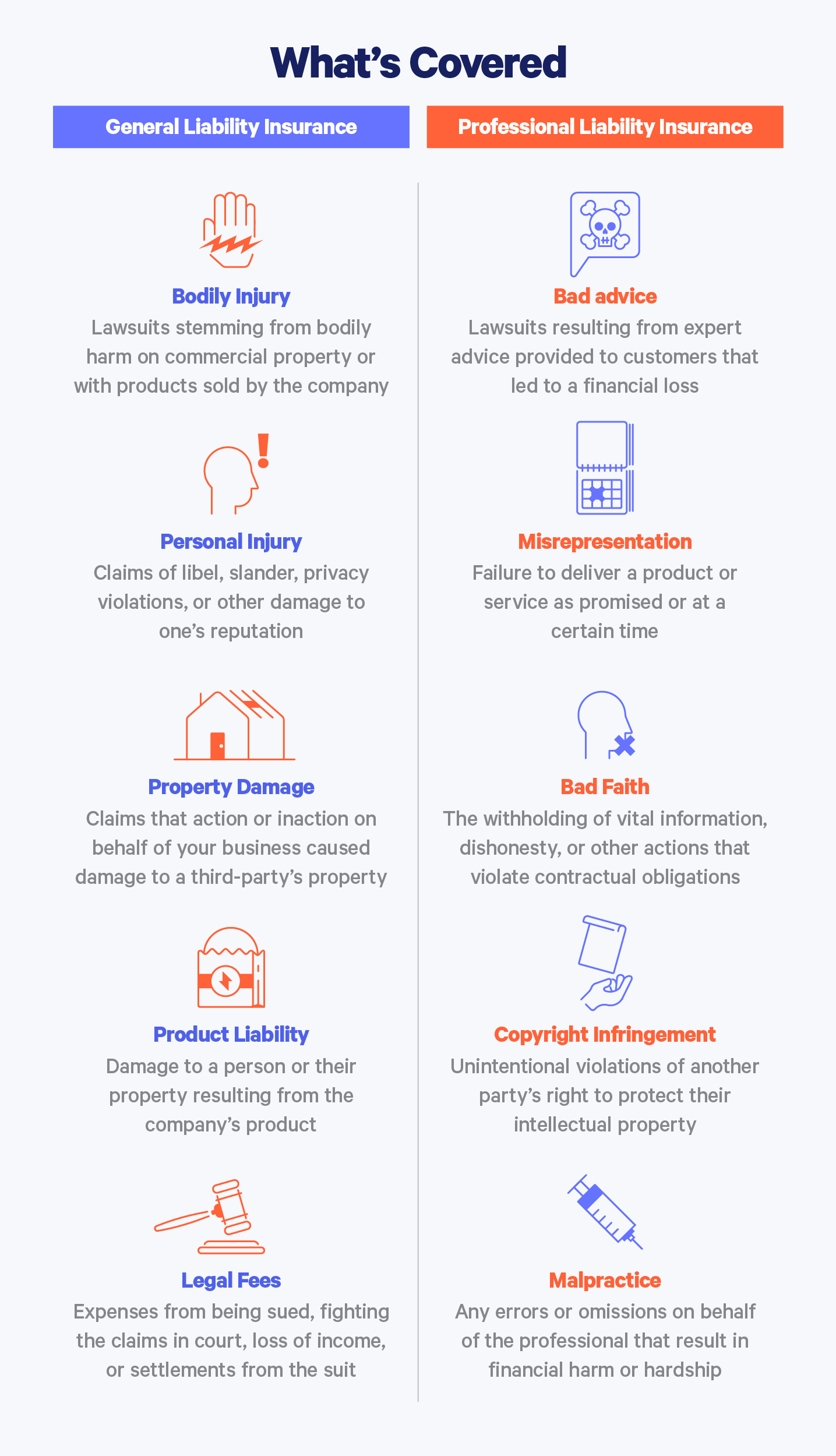

Comparing General And Professional Liability

It’s important to distinguish between general liability insurance and professional liability insurance. While general liability insurance primarily covers physical risks such as bodily injuries and property damage, professional liability insurance specifically addresses claims related to professional services, negligence, and errors.

Claims Typically Covered By Pli

Professional liability insurance typically covers a wide range of claims, including allegations of negligence, errors, omissions, misrepresentation, violation of good faith and fair dealing, and inaccurate advice. It also extends to claims of copyright infringement, personal injury, and other professional risks.

Moreover, PLI may provide coverage for legal defense costs, settlements, and judgments, offering financial protection and peace of mind for professionals and businesses.

It’s important to note that each policy may have variations in coverage, exclusions, and limitations, so it’s crucial to review the specific terms and conditions of your professional liability insurance policy.

Choosing The Right Policy

When it comes to professional liability insurance, choosing the right policy is crucial for protecting your business and professional reputation. Assessing your professional risks and understanding the policy features to look for are essential steps in the process.

Assessing Your Professional Risks

Before selecting a professional liability insurance policy, it’s important to assess the specific risks associated with your profession. Consider the nature of your work, the potential for errors or omissions, and the likelihood of facing claims from clients or customers. By understanding your professional risks, you can choose a policy that provides adequate coverage for your unique needs.

Policy Features To Look For

When evaluating professional liability insurance policies, there are several key features to look for:

- Coverage Limits: Ensure that the policy offers sufficient coverage limits to protect against potential claims and legal expenses.

- Claims History: Review the insurer’s claims history and reputation for handling claims fairly and efficiently.

- Customization Options: Look for policies that can be customized to address the specific risks and challenges of your profession.

- Legal Support: Check if the policy provides access to legal support and defense in the event of a claim.

By carefully considering these policy features, you can make an informed decision when choosing the right professional liability insurance policy for your business.

Pli For Small Businesses And Freelancers

Professional Liability Insurance (PLI) is crucial for small businesses and freelancers to safeguard against potential risks and legal claims. It offers protection in case of negligence, errors, or omissions in the services provided.

Importance Of Pli For Small Entities

1. Financial Protection: PLI shields small businesses and freelancers from bearing the full financial burden of legal claims or lawsuits.

2. Credibility Boost: Having PLI demonstrates professionalism and reliability to clients, enhancing trust and credibility.

Customizing Coverage To Business Size

1. Tailored Solutions: PLI policies can be customized to suit the specific needs and size of a small business or freelancer.

2. Affordable Options: Small entities can opt for cost-effective PLI plans that provide adequate coverage without breaking the bank.

3. Risk Mitigation: By customizing coverage, small businesses can mitigate risks effectively and ensure comprehensive protection.

Navigating Claims And Legalities

Navigating claims and legalities with a professional liability insurance company involves protecting against negligence claims from clients. This insurance covers areas like copyright infringement and personal injury, safeguarding professionals and businesses from potential lawsuits. Trusted insurers like AIG and Hiscox offer tailored coverage for various industries and freelancers.

Navigating claims and legalities can be a daunting task for professionals and businesses, especially when it comes to professional liability insurance. In the event of a claim, it is important to have a clear understanding of the claims process and legal support available. This is where a reliable professional liability insurance company can make all the difference.The Claims Process Simplified

The claims process for professional liability insurance can vary depending on the insurance company and policy. However, most claims typically follow a similar process. Once a claim is filed, the insurance company will assign a claims adjuster to investigate the claim and determine if it is covered under the policy. If the claim is covered, the insurance company will work with the policyholder to resolve the claim, which may include paying damages or providing legal defense. It is important to keep detailed records of all interactions with the insurance company and provide any requested information in a timely manner to ensure a smooth claims process.Legal Support And Liability Protection

In addition to covering damages and legal defense costs, many professional liability insurance policies also provide legal support and liability protection. This can include access to legal resources such as attorneys and legal advice, as well as protection against claims of negligence or other professional misconduct. Having this type of support can be invaluable in the event of a claim, helping to minimize the impact on your business and reputation.Overall, navigating claims and legalities with professional liability insurance can be complex, but having a trusted insurance company by your side can make all the difference. With a clear understanding of the claims process and legal support available, you can be confident in the protection provided by your professional liability insurance policy.Future Of Professional Liability Insurance

Professional Liability Insurance (PLI) is an indispensable component for professionals and businesses, safeguarding them against claims of negligence and errors. As the business landscape evolves, it is crucial to anticipate the future of Professional Liability Insurance and the factors that will shape it.

Trends Affecting Pli

The landscape of Professional Liability Insurance is being influenced by several key trends. These include advancements in technology, changes in consumer behavior, and the evolving regulatory environment. Technological innovations such as artificial intelligence and automation are revolutionizing the risk assessment and claims process, while consumer expectations for personalized services are driving the need for tailored insurance solutions. Additionally, regulatory changes are shaping the legal and compliance landscape, impacting the requirements for professional liability coverage.

Innovations In Insurance Products

The insurance industry is witnessing a wave of innovations in products and services aimed at enhancing the scope and effectiveness of Professional Liability Insurance. Insurers are developing customized solutions that address the specific needs of different professions, offering more comprehensive coverage and flexible policy options. Furthermore, the integration of data analytics and risk modeling is enabling insurers to provide proactive risk management strategies, empowering businesses to mitigate potential liabilities effectively.

Credit: www.propertycasualty360.com

Frequently Asked Questions

What Is A Professional Liability Insurance Company?

A professional liability insurance company provides coverage for businesses against claims of negligence from clients.

Who Has The Best Professional Liability Insurance?

AIG is considered the best for professional liability insurance, with options for different professions like freelancers, medical providers, lawyers, and small businesses.

What Is Pli In Medical Billing?

PLI in medical billing stands for Professional Liability Insurance. It is a type of insurance that provides coverage for healthcare professionals against claims of negligence from their clients or patients. PLI typically covers issues like malpractice, errors, and omissions, among others.

While not required in most cases, having PLI can provide peace of mind for healthcare professionals and protect their practice from financial risks.

Is Professional Liability Insurance Required In Texas?

Professional liability insurance is not required in Texas, but may be necessary in certain industries or for government contracts.

Conclusion

Professional liability insurance companies play a crucial role in safeguarding businesses against claims of negligence. These companies offer coverage for various risks such as copyright infringement and personal injury. It’s essential for professionals and businesses to consider getting professional liability insurance to protect their interests.