Looking for a cheap car insurance company in Austin, Texas, United States? Check out affordable options like State Farm, Texas Farm Bureau, Geico, and more.

These companies offer competitive rates for drivers looking to save on their auto insurance premiums. By comparing quotes and exploring different coverage options, you can find a policy that fits your budget while meeting your insurance needs. Whether you are a safe driver or have a few blemishes on your record, these companies may have the right coverage for you at a price you can afford.

Save money on car insurance without sacrificing quality coverage with these top insurance providers in Austin, Texas.

Secrets To Finding Affordable Car Insurance

Car insurance is a must-have for every car owner, but the cost of insurance can be a significant financial burden. Finding affordable car insurance can seem like a daunting task, but it is possible. By understanding the factors that affect insurance rates and comparing insurance providers, you can save hundreds of dollars on your car insurance premiums.

Factors That Affect Insurance Rates

The cost of car insurance is influenced by various factors, including your driving history, age, gender, location, and type of car. Here are some of the factors that affect car insurance rates:

| Factor | Description |

|---|---|

| Driving History | If you have a history of accidents, traffic violations, or DUIs, your insurance rates will be higher. |

| Age | Younger drivers and senior drivers are considered high-risk drivers and pay higher insurance rates. |

| Gender | Women drivers are considered safer drivers and pay lower insurance rates compared to male drivers. |

| Location | The location of your residence and where you park your car can affect your insurance rates. |

| Type of Car | The make and model of your car can affect your insurance rates. Sports cars and luxury cars are more expensive to insure compared to family cars. |

Understanding these factors can help you make informed decisions when choosing a car and insurance policy. You can also take steps to improve your driving record and reduce your insurance rates.

Comparing Insurance Providers

When looking for affordable car insurance, it’s essential to compare insurance providers to find the best deal. Here are some tips to help you compare insurance providers:

- Get quotes from multiple insurance providers

- Compare coverage and deductibles

- Check for discounts and special offers

- Read reviews and ratings of insurance providers

- Consider the financial strength and stability of the insurance company

By comparing insurance providers, you can find the best coverage at the most affordable price.

Now that you know the secrets to finding affordable car insurance, you can start saving money on your car insurance premiums. Remember to keep your driving record clean, choose the right car, and compare insurance providers to find the best deal.

Insurance Rates: Myths Vs. Facts

When it comes to finding the right cheap car insurance company, it’s essential to separate the myths from the facts. Understanding what influences your premium can help you make informed decisions when choosing an insurance provider.

Common Misconceptions

- Red cars cost more to insure – False

- Older drivers always pay less – False

- Insurance rates don’t change – False

What Influences Your Premium?

Several factors can impact your insurance rates, including:

- Driving record: Accidents and tickets can increase rates.

- Vehicle type: Some cars are more expensive to insure.

- Location: Urban areas may have higher premiums.

- Coverage level: Comprehensive coverage costs more.

Understanding these influences can help you navigate the world of car insurance and find the best rates for your needs.

Leveraging Discounts And Deals

When it comes to finding affordable car insurance, leveraging discounts and deals can make a significant impact on the overall cost. Many insurance companies offer various discounts and deals that can help drivers save money on their car insurance premiums. Understanding the types of discounts available and how to qualify for savings can help you make the most of these opportunities.

Types Of Discounts Available

Car insurance companies offer a range of discounts to help policyholders save on their premiums. Some common types of discounts available include:

- Multi-vehicle discount

- Safe driver discount

- Good student discount

- Low mileage discount

- Bundling discount (combining auto and home insurance)

- Occupational discount

- Senior driver discount

- Anti-theft device discount

How To Qualify For Savings

To qualify for these savings, drivers can take specific steps such as:

- Maintaining a clean driving record

- Completing a defensive driving course

- Providing evidence of good grades for student discounts

- Installing anti-theft devices in the vehicle

- Consolidating multiple insurance policies with the same provider

- Driving fewer miles annually

- Exploring occupation-based discounts

The Role Of Credit Scores In Insurance Costs

When it comes to securing affordable car insurance, understanding the role of credit scores in insurance costs is crucial. Your credit score can significantly impact the rates you receive from insurance companies. This article will delve into the importance of credit scores in determining insurance costs and provide tips on how to improve your credit to secure better rates.

Understanding Your Credit Score

Your credit score is a numerical representation of your creditworthiness. Insurance companies often use this score as a factor in determining your insurance premiums. A higher credit score typically translates to lower insurance costs, while a lower score may result in higher premiums. It’s important to understand the components that contribute to your credit score, such as payment history, credit utilization, length of credit history, new credit accounts, and types of credit used.

Improving Your Credit For Better Rates

If you have a lower credit score and are looking to secure better rates on your car insurance, there are steps you can take to improve your credit. Start by reviewing your credit report for any errors and addressing them promptly. Paying bills on time, reducing outstanding debt, and avoiding opening multiple new credit accounts can also help boost your credit score. Taking these proactive measures can lead to improved credit and potentially lower insurance premiums.

Comparing Quotes: A Strategic Approach

When it comes to finding the most affordable car insurance, comparing quotes is a strategic approach that can save you a significant amount of money. With a plethora of options available, it’s crucial to leverage online tools and resources, understand the importance of personalized quotes, and make informed decisions based on the gathered information.

Online Tools And Resources

Utilizing online tools and resources is the first step in the quest for cheap car insurance. Websites and platforms offer comparison tools that allow you to input your information and receive quotes from multiple insurance companies simultaneously. This not only saves time but also provides a comprehensive overview of available options, empowering you to make an informed decision.

The Importance Of Personalized Quotes

Personalized quotes take into account your specific details, such as driving history, location, and vehicle type, to provide accurate pricing tailored to your individual circumstances. This personalized approach ensures that you are not overpaying for coverage that may not be suitable for your needs. It also allows you to identify potential discounts or special offers that apply to your unique situation, ultimately leading to more cost-effective car insurance.

High-risk Drivers: Finding Affordable Coverage

When it comes to finding affordable car insurance, high-risk drivers often face challenges due to their driving history. However, despite the obstacles, it is possible for high-risk drivers to obtain coverage that is both comprehensive and cost-effective. By understanding the specific needs of high-risk drivers and exploring the available insurance options, it is feasible to secure suitable coverage without breaking the bank.

Identifying High-risk Profiles

High-risk drivers encompass individuals with a history of traffic violations, accidents, DUI convictions, or lapses in insurance coverage. Additionally, young and inexperienced drivers may also fall into this category due to their higher likelihood of being involved in accidents. Insurance companies typically consider these factors when determining the level of risk associated with a driver, which can result in higher premiums.

Insurance Options For High-risk Drivers

Despite the challenges, there are several insurance options tailored to high-risk drivers. Some companies specialize in providing coverage for high-risk individuals, offering competitive rates and flexible payment plans. Additionally, high-risk drivers can explore state-sponsored insurance programs or seek assistance from independent insurance agents who can help find suitable coverage at affordable rates.

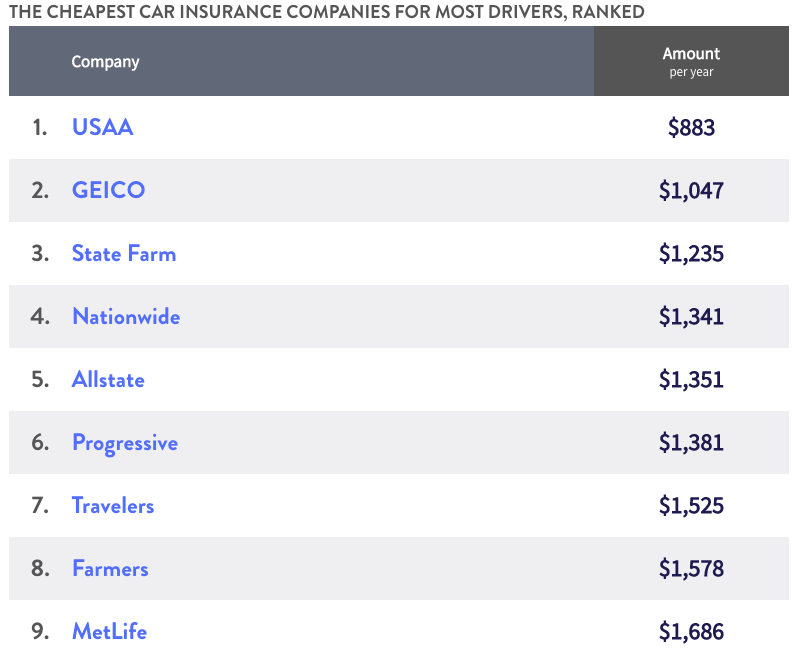

The Cheapest Car Insurance Companies In Texas

When it comes to finding affordable car insurance in Texas, it’s essential to explore the options provided by different insurance companies. Understanding the top contenders for low-cost insurance and the differences between regional insurance providers and national chains can help you make an informed decision.

Top Contenders For Low-cost Insurance

Looking for the cheapest car insurance in Texas? Here are some of the top contenders:

- Allstate: Offers bundle discounts for auto and home policies.

- Root Insurance: Known for affordable rates and good driving rewards.

- State Farm: Provides low-cost auto insurance options.

- Progressive: Offers affordable auto insurance and unique discounts.

Regional Insurance Providers Vs. National Chains

When comparing regional insurance providers and national chains, consider factors like customer service, coverage options, and pricing:

| Regional Insurance Providers | National Chains |

|---|---|

| Personalized service | Wider network of agents |

| Local market expertise | Nationwide brand recognition |

| Flexible coverage options | Consistent policies across states |

Credit: family1st.io

Maximizing Savings With Bundled Policies

Maximize your savings by bundling policies with a cheap car insurance company. Combine auto and home insurance for discounts and comprehensive coverage options. Save money without sacrificing quality protection for your vehicles and property.

Maximizing Savings with Bundled PoliciesCar insurance is a necessary expense, but that doesn’t mean you can’t find ways to save. One option for reducing your car insurance premium is to bundle your policies. In this article, we’ll explore what bundled policies are, the pros and cons of insurance bundling, and how you can maximize your savings with bundled policies.What Are Bundled Policies?

Bundled policies are a type of insurance package that combines two or more policies from the same company. For example, you might bundle your car insurance with your homeowners or renters insurance. By bundling your policies, you can often save money on your premiums, as insurance companies typically offer discounts for bundled policies.Pros And Cons Of Insurance Bundling

There are several pros to bundling your insurance policies. Firstly, bundling can save you money on your premiums, as insurers often offer discounts for bundled policies. Secondly, bundling your policies can make managing your insurance easier, as you only have to deal with one company for all your policies. Finally, bundling can provide greater coverage, as some policies may offer benefits that overlap.However, there are also some cons to bundling your insurance policies. Firstly, bundling may not always be the cheapest option, as you may be able to find cheaper policies from different companies. Secondly, bundling can limit your options, as you may not be able to customize your policies as much as you would if you purchased them separately. Finally, bundling may not always provide the best coverage, as some policies may not offer the same level of coverage as standalone policies.Maximizing Your Savings With Bundled Policies

If you’re considering bundling your insurance policies, there are a few things you can do to maximize your savings. Firstly, shop around and compare quotes from different insurers to find the best deal. Secondly, consider your coverage needs carefully, and make sure that bundling your policies won’t leave you underinsured. Finally, be sure to ask your insurer about any discounts or promotions that may be available for bundled policies.In conclusion, bundled policies can be a great way to save money on your car insurance premiums. However, it’s important to weigh the pros and cons carefully, and to shop around to find the best deal. By following these tips, you can maximize your savings and enjoy greater peace of mind knowing that you’re fully covered.The Impact Of Car Make And Model On Insurance

The car make and model significantly impact insurance costs with Cheap Car Insurance Companies. Factors like safety ratings and repair costs influence premiums. Selecting a vehicle with lower insurance risk can help save money on coverage.

How Vehicle Type Affects Rates

The type of vehicle you drive directly impacts your insurance rates. Insurers consider factors such as safety ratings, repair costs, and theft rates when determining premiums. Sports cars and luxury vehicles typically have higher insurance rates due to their higher repair costs and increased likelihood of theft.Choosing A Car With Lower Insurance Costs

When selecting a car, opt for models with good safety features and lower repair costs. Compact cars and family-friendly SUVs often have cheaper insurance rates compared to high-performance vehicles. Additionally, electric cars and hybrids may qualify for discounts due to their eco-friendly nature and lower risk of accidents.Choose a car that not only fits your lifestyle but also helps you save on insurance premiums in the long run.

Credit: www.motorbiscuit.com

Navigating Post-accident Insurance Rates

After an accident, it’s crucial to understand how it may impact your car insurance rates. Navigating post-accident insurance rates can be challenging, but with the right approach, it’s possible to maintain affordable coverage. Here’s a guide to help you through the process.

Steps To Take After An Accident

Following an accident, taking the right steps can help mitigate potential increases in your insurance rates. Here are some important actions to consider:

- Ensure everyone involved in the accident is safe and seek medical attention if necessary.

- Contact the police and file an accident report.

- Exchange insurance and contact information with the other party involved.

- Document the accident scene with photos and gather witness information if possible.

- Notify your insurance company about the accident as soon as possible.

Maintaining Low Rates Post-incident

Once the dust has settled after an accident, there are steps you can take to help maintain low insurance rates:

- Consider taking a defensive driving course to demonstrate your commitment to safe driving.

- Review your coverage and consider adjusting it based on your current needs and budget.

- Monitor your driving habits and strive to maintain a clean record.

- Shop around for competitive rates from different insurance providers.

- Seek advice from your insurance agent to explore available options for rate management.

Credit: coastalinsurancesolution.com

Frequently Asked Questions

Who Normally Has The Cheapest Car Insurance?

Drivers with a clean record and low-risk occupations usually have the cheapest car insurance.

Who Pays The Cheapest Car Insurance?

State Farm, Texas Farm Bureau, and Geico are among the cheapest car insurance companies in Texas.

Who Has The Lowest Auto Insurance Rates In Texas?

The cheapest car insurance companies in Texas are Texas Farm Bureau, State Farm, Geico, Redpoint County Mutual, and Mercury Insurance. However, the rates may vary depending on the individual’s driving history, age, and other factors. It’s best to compare quotes from multiple providers to find the lowest rate.

Who Is Cheaper, Geico Or Progressive?

Geico typically offers lower rates overall, while Progressive may be better for high-risk drivers. Costs vary based on factors like age and driving history.

Conclusion

Finding affordable car insurance is crucial, and with the right research, you can secure a great deal. Consider factors such as coverage, discounts, and customer service when choosing a provider. It’s important to compare quotes and tailor the policy to your specific needs.

With the right approach, you can find reliable coverage without breaking the bank.