Looking for the best home insurance in Austin, Texas? You can find top options from Progressive, State Farm, and Allstate.

With various coverage options and competitive rates, these companies offer reliable protection for your home and possessions. When it comes to safeguarding your home and belongings, having the best home insurance is crucial. In Austin, Texas, residents can choose from a range of reputable insurers like Progressive, State Farm, and Allstate.

These companies provide personalized insurance solutions, bundle policies for added savings, and offer competitive rates. Whether you’re a homeowner or a renter, finding the best coverage for your specific needs is essential. With a quick online quote, you can easily compare options and secure the best home insurance for your property in Austin.

Credit: www.usnews.com

Securing Your Home Sweet Home

Make sure your home sweet home is protected with the best home insurance in Austin, Texas. Find affordable rates and personalized coverage options from top providers like State Farm, Allstate, and USAA. Bundle your home and auto policies to save even more today.

The Importance Of Home Insurance

Securing your home sweet home is a top priority for everyone. It’s where you feel most comfortable and safe. However, accidents and disasters can happen at any time, which can lead to significant financial losses. That’s where home insurance comes in. Home insurance provides you with financial protection against damages or losses to your home and personal property due to theft, fire, natural disasters, and other covered events.Home insurance is not just a legal requirement; it’s also a smart investment that protects your most valuable asset. It offers you peace of mind and ensures that you won’t have to pay for expensive repairs or replacements out of pocket.Factors That Influence Home Insurance Rates

When you’re shopping for home insurance, it’s essential to understand the factors that can affect your rates. Here are some of the most common factors that insurance companies consider when determining your premium:- Location: The location of your home can significantly impact your insurance rates. If you live in an area prone to natural disasters or high crime rates, you may pay more for insurance.

- Age and condition of your home: Older homes or homes in poor condition may be more expensive to insure because they’re more prone to damage.

- Size and value of your home: The larger and more expensive your home is, the more you’ll pay for insurance.

- Deductible: Your deductible is the amount you’ll pay out of pocket before your insurance kicks in. Higher deductibles can lower your premium, but you’ll pay more if you file a claim.

- Credit score: Your credit score can also impact your insurance rates. People with higher credit scores are considered less of a risk and may pay less for insurance.

Comparing Top Providers

When it comes to securing the best home insurance policy, it’s crucial to compare offerings from the top providers in the market. Let’s delve into the specifics of two major players in the industry: State Farm and Progressive.

State Farm: A Comprehensive Look

State Farm stands out for its comprehensive coverage options, tailored to meet the diverse needs of homeowners. With a strong financial backing and a solid reputation, State Farm offers a wide range of policies to protect your home and belongings.

Progressive: Beyond The Superstore Of Insurance

Progressive goes beyond being just a superstore of insurance, offering innovative solutions and competitive rates. Their focus on customer satisfaction and flexibility in policies make them a popular choice among homeowners looking for reliable coverage.

Regional Focus: Best Picks For Austin, Texas

Discover the best home insurance options in Austin, Texas with top picks from State Farm, Farmers, Chubb, USAA, and Texas Farm Bureau. Protect your home and possessions at an affordable price and find the right coverage to suit your needs.

Get personalized quotes and bundle policies to save on your home insurance.

Local Insurance Climate

In the vibrant city of Austin, Texas, homeowners are faced with the unique insurance climate of the Lone Star State. With the threat of severe weather events such as hailstorms and tornadoes, finding the right home insurance that provides comprehensive coverage is paramount.

Top Rated Insurers In The Lone Star Capital

When it comes to securing the best home insurance in Austin, Texas, it’s essential to consider reputable insurers that offer tailored coverage and exceptional customer service.

Here’s a list of top-rated insurers for homeowners in Austin:

- Progressive: Protect your home and possessions at an affordable price with personalized insurance solutions.

- Stine Bros Agency: Offering personalized insurance solutions for auto, home, life, business, and more, including bundled policies for savings.

- State Farm: A leading home insurance company, providing reliable coverage at competitive rates.

- Nationwide: Trusted for its comprehensive homeowners insurance options and excellent customer support.

- Allstate: Known for its customizable policies and innovative coverage options for homeowners.

- Travelers: Providing flexible and customizable home insurance policies to meet the diverse needs of homeowners in Austin.

These insurers have been recognized for their exceptional offerings and commitment to ensuring homeowners in Austin have the best insurance protection available.

When seeking the best homeowners insurance in Austin, Texas, these top-rated insurers stand out for their comprehensive coverage, competitive rates, and dedication to customer satisfaction.

Insurance For Every Stage Of Life

Optimizing Coverage For Seniors

As individuals reach their senior years, their insurance needs may change. It’s essential to optimize coverage to align with the specific requirements of this stage of life. This may involve adjusting home insurance policies to address potential risks and ensure comprehensive protection for seniors.

Adapting Policies For New Homeowners

For new homeowners, adapting insurance policies is crucial. It’s important to tailor the coverage to the unique needs and circumstances of owning a new home. This may include considering factors such as property value, location, and specific coverage options that align with the homeowner’s stage of life.

Balancing Cost And Coverage

When it comes to protecting your home, finding the right balance between cost and coverage is crucial. Home insurance is a necessity, but it’s essential to ensure that you’re not overpaying for unnecessary coverage while still safeguarding your property and belongings. Understanding the trade-offs and finding affordable home insurance can provide the peace of mind you need without breaking the bank.

Finding Affordable Home Insurance

When looking for affordable home insurance, it’s important to compare quotes from multiple insurance providers. Consider bundling your home and auto policies to save money. Additionally, inquire about discounts for home security systems, smoke detectors, and other safety features. By exploring different options, you can find a policy that offers the right coverage at a price that fits your budget.

Understanding The Trade-offs

As you seek affordable home insurance, it’s crucial to understand the trade-offs involved. Lower premiums may come with higher deductibles and less comprehensive coverage. Evaluate the potential risks and benefits of different policy options to make an informed decision. While cost is important, it’s equally essential to ensure that your policy adequately protects your home and possessions in various scenarios.

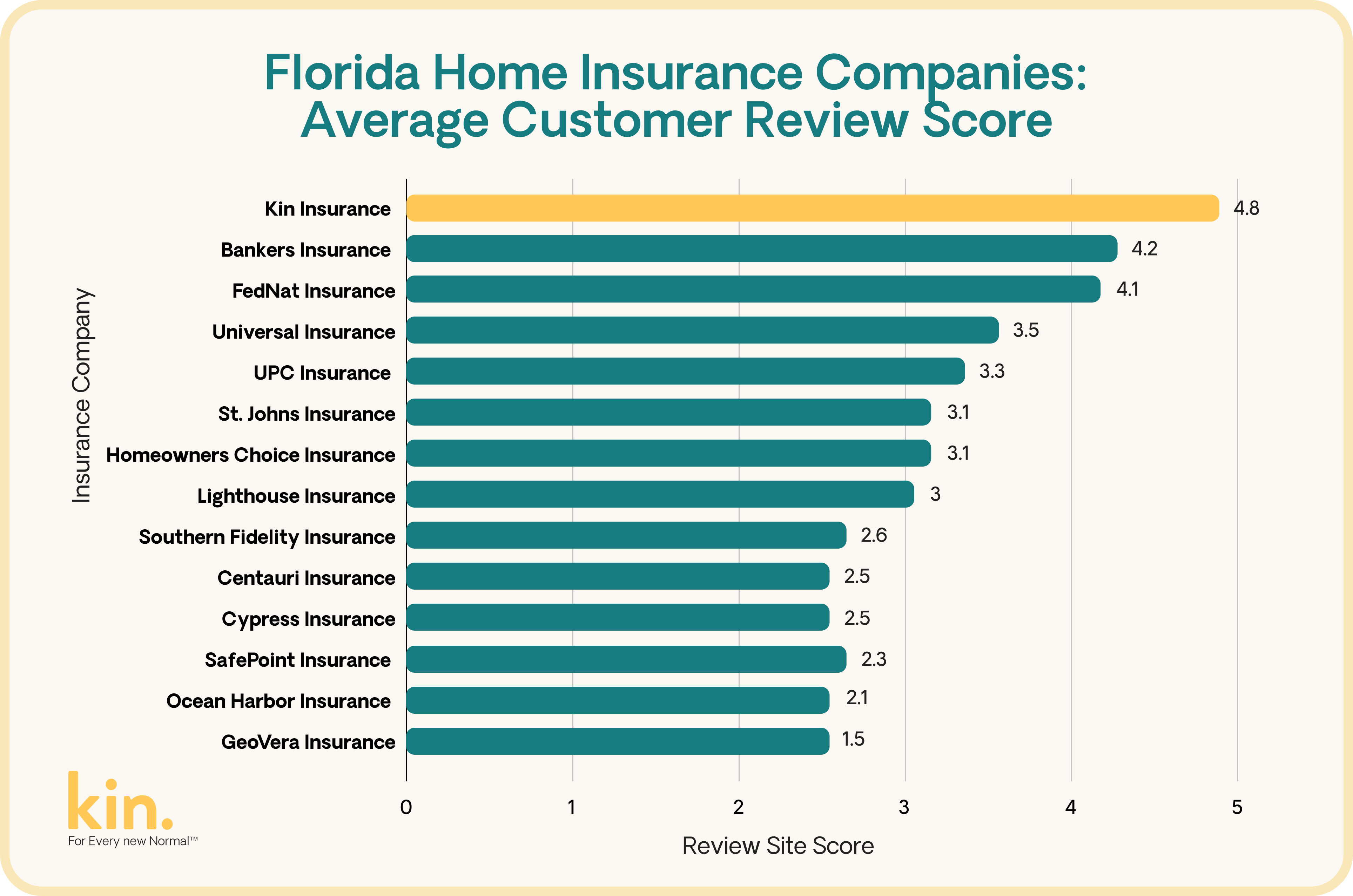

Credit: www.kin.com

Policy Bundling: The Smart Move?

When it comes to safeguarding your home, finding the best insurance policy is crucial. Policy bundling, where you combine multiple insurance policies from the same provider, has gained popularity as a smart move to protect your home and save on premiums. Let’s delve into the pros and cons of bundling, as well as how it affects your premiums.

Pros And Cons Of Bundling

Policy bundling offers the convenience of managing multiple policies under one provider. It simplifies paperwork and often comes with a discount. However, bundling may limit your options and lead to higher premiums if the bundled policies don’t align with your needs.

How Bundling Affects Premiums

Bundling policies usually results in cost savings, as insurance companies offer discounts for combining multiple policies. This can lead to lower overall premiums, making policy bundling an attractive option for homeowners. However, it’s essential to carefully review the bundled policies to ensure they meet your specific coverage needs.

Special Considerations

When it comes to selecting the best home insurance policy, there are some special considerations to keep in mind. From flood insurance to coverage for high-risk areas, understanding these factors is crucial to protecting your home and belongings.

Flood Insurance: Do You Need It?

Flood insurance is essential for homeowners in flood-prone regions to protect against costly water damage not covered by standard policies.

- Consider your home’s location and evaluate the risk of flooding in your area.

- Review the National Flood Insurance Program (NFIP) and consider purchasing a policy for added protection.

- Consult with your insurance provider to determine the best coverage options for your specific needs.

Insurance For High-risk Areas

Living in a high-risk area can impact your home insurance rates and coverage options. Understand the following considerations:

- Determine if your home is in a high-risk area based on factors such as proximity to coastlines or geological risks.

- Explore specialized insurance options for high-risk areas that provide additional coverage for specific risks.

- Work with your insurance agent to ensure you have adequate coverage for potential hazards in your region.

Navigating Insurance Ratings And Reviews

Discover the top-rated home insurance providers through insightful ratings and reviews. Easily navigate through the best options available for your home insurance needs.

Navigating the world of insurance can be overwhelming, especially when it comes to finding the best home insurance policy. With so many options available, it can be difficult to know where to start. One way to narrow down your choices is by reading insurance ratings and reviews. This can give you an idea of what to expect from different insurance providers and help you make an informed decision. In this section, we’ll explore how to decipher consumer reports, Reddit, and real user experiences to find the best home insurance policy for your needs.Deciphering Consumer Reports

Consumer Reports is a well-known source for unbiased reviews and ratings of various products and services, including home insurance policies. Their ratings are based on a variety of factors, such as customer satisfaction, claims handling, and pricing. When looking at Consumer Reports, it’s important to pay attention to the overall score and how each provider ranks in different categories. This can give you a better idea of which insurance providers may be the best fit for your needs.Reddit And Real User Experiences

Another way to gauge the quality of an insurance provider is by looking at real user experiences, such as on Reddit. Users can share their experiences with different insurance providers, including both positive and negative reviews. While it’s important to take these reviews with a grain of salt, they can provide valuable insights into how an insurance provider handles claims and customer service. It’s also a good idea to look at reviews from multiple sources to get a well-rounded understanding of each provider.Overall, navigating insurance ratings and reviews can be a helpful tool in finding the best home insurance policy for your needs. By looking at Consumer Reports, Reddit, and real user experiences, you can get a better idea of what to expect from different insurance providers and make an informed decision.The Claims Process Unveiled

When it comes to home insurance, understanding the claims process is crucial. Knowing how to file a claim and what to expect can make a significant difference in the outcome.

Filing A Claim: Steps To Take

- Contact your insurance provider immediately after the incident.

- Provide detailed information about the damage or loss.

- Document the damage with photos or videos if possible.

- Fill out the claim form accurately and truthfully.

What To Expect After Filing

- A claims adjuster will be assigned to assess the damage.

- You may need to provide additional documentation or information.

- Expect communication from your insurance company throughout the process.

- Once the claim is approved, you will receive compensation based on your policy.

Credit: www.agilerates.com

Future-proofing Your Home Insurance

When it comes to safeguarding your home, having the right insurance coverage is essential. Future-proofing your home insurance ensures that you are prepared for any unforeseen events that may arise.

Keeping Up With Changing Needs

As life evolves, so do your needs. Regularly reviewing your home insurance policy can help ensure that you have adequate coverage for your current situation. Consider factors such as home improvements, renovations, or acquiring valuable items.

Annual Check-ups: Staying Covered

Annual check-ups with your insurance provider can help you stay up-to-date with any changes in your coverage needs. Discuss any significant changes in your life or home that may impact your insurance requirements.

Frequently Asked Questions

Who’s The Best Homeowners Insurance?

State Farm, Farmers, Chubb, USAA, and Texas Farm Bureau are top picks for best homeowners insurance in Austin, Texas.

What Is The 80% Rule In Homeowners Insurance?

The 80% rule in homeowners insurance is a guideline that suggests homeowners should insure their property for at least 80% of its total replacement cost. This means that if the cost of rebuilding or repairing your home is $100,000, you should have at least $80,000 worth of insurance coverage.

Not meeting this requirement can result in a penalty or reduced claim payment in the event of a loss.

Who Is The Number One Home Insurance Company In America?

State Farm is the number one home insurance company in America, offering reliable coverage nationwide.

Who Has The Lowest Homeowners Insurance Rates?

The homeowners insurance rates vary, but companies like State Farm, Allstate, and USAA often offer competitive rates.

Conclusion

Securing the best home insurance is crucial for protecting your home and belongings. Explore different options, compare quotes, and choose a reputable provider like State Farm or Allstate for peace of mind. Safeguard your investment with the right coverage today.